Introduction

Gone are the days when having a stable 9-to-5 job was the only path to financial security. Today, many Millennials and Gen Z in Singapore are turning their passions into profitable side hustles, whether it’s running an online store, offering freelance services, or launching a home-based food business. With rising living costs and an increased desire for flexibility, a side hustle isn’t just a hobby anymore; it’s a pathway to financial freedom and independence.

However, turning passion into profit often requires capital. Many aspiring entrepreneurs struggle with funding their ideas, especially when it comes to purchasing equipment, stocking up on inventory, or investing in marketing. That’s where small business loans for side hustles come in. These loans can bridge the gap between ideas and execution, giving you the boost you need to start or scale your business.

But where should you begin? How do you know if borrowing is the right move for your side hustle? That’s exactly what this guide is here to help you figure out.

In the following sections, we’ll explore how small business loans for side hustles can fuel your growth, the smartest ways to use your borrowed funds, and what kinds of businesses benefit the most. You’ll also learn about responsible financial management, alternative funding options, and key strategies to make your loan work in your favour.

Key Takeaways

- Strategic Borrowing Fuels Growth – Using small business loans for side hustles wisely can fund equipment, inventory, and marketing to scale your side hustle faster.

- Budgeting Prevents Debt Traps – Borrow only what you need, plan repayments, and reinvest profits to ensure your loan contributes to long-term business success.

- Alternative Financing Options Exist – Beyond banks, options like licensed money lenders, P2P platforms, and government microloans make funding more accessible and flexible for side hustlers.

Whether you’re just getting started or looking to expand your side hustle into a full-fledged business, this guide will equip you with the knowledge to borrow wisely, invest strategically, and build long-term success.

Smart Borrowing: How to Use a Loan to Strengthen Your Side Hustle Finances

Before we dive into how to spend wisely, let’s first understand the purpose of borrowing for your side hustle. Small business loans for side hustles aren’t just about having extra cash; it’s about strategically using funds to create value, improve operations, and grow your business faster than you could on your own.

Here’s how.

1. Invest in Essential Equipment

Quality tools and equipment can set your side hustle apart. Whether you’re a photographer needing a professional-grade camera or a baker upgrading to a commercial oven, having the right tools improves the quality of your offerings. With a small business loan for side hustles, you can invest upfront in equipment that not only enhances productivity but also elevates the customer experience. For example, a videographer with a high-end camera can attract higher-paying clients, while a home baker with better ovens can take on larger orders without compromising quality.

2. Stock Up On Inventory

Cash flow challenges often make it difficult to buy in bulk. Yet, purchasing in larger quantities usually lowers costs per unit and boosts profit margins. By using small business loans for side hustles, you can stock up on materials or products without depleting your day-to-day working capital. This financial flexibility ensures you’re prepared for seasonal spikes, unexpected demand, or new product launches.

3. Boost Marketing Efforts

Even the most exceptional products need visibility to succeed. Investing in marketing, be it social media ads, influencer partnerships, or search engine optimisation, can significantly expand your reach and customer base. With funding from a small business loan, you can launch targeted campaigns that generate consistent sales and grow brand recognition.

4. Streamline Operations

As your side hustle grows, handling everything alone can become overwhelming. A loan can help you hire part-time help, subscribe to automation tools, or outsource critical tasks like bookkeeping and order fulfilment. By delegating or automating routine operations, you free up valuable time to focus on business development, strategy, and customer engagement, key drivers of growth for any side hustle.

By borrowing strategically and targeting the areas that create the most impact, you can ensure every dollar of your loan contributes to growth, productivity, and long-term success.

What Type of Side Hustles Benefit the Most from Small Loans?

Now that we’ve explored how to use a loan strategically, the next question is: which side hustles benefit the most from this financial boost? Not all ventures have the same capital needs, so identifying businesses where small loans can create the most impact is key.

1. E-commerce & Online Retail

Running an online store is more than just listing products as it requires a steady supply of stock, professional product photography, and effective marketing. With a small business loan for side hustles, you can secure inventory in advance, experiment with new product lines, and fund ad campaigns that attract the right customers. This upfront investment can translate into higher sales and faster growth for your online shop.

2. Freelancing (Photography, Videography, Graphic Design)

Creative freelancers often face the challenge of producing high-quality work while managing costs. Investing in top-tier tools like cameras, editing software, or drawing tablets can be expensive, but it directly impacts the quality of your output. A small loan allows freelancers to upgrade their gear, take on more complex projects, and attract premium clients without waiting months to save.

3. Food & Beverage

From home bakers to aspiring café owners, the F&B industry comes with unavoidable upfront costs, ingredients, kitchen equipment, and packaging. With a small business loan for SME, you can meet larger orders, invest in professional-grade tools, and even explore new recipes or product lines. This financial flexibility ensures you don’t miss growth opportunities because of cash flow limitations.

4. Fitness Coaching & Personal Training

Whether offering in-person sessions or launching an online programme, fitness entrepreneurs often need funds to purchase equipment, rent a suitable space, or create an engaging digital platform. A small business loan for side hustles can help you establish a professional setup, attracting clients who are willing to pay for quality training.

By targeting the right type of side hustle, a loan can become a catalyst for growth, helping you move from a small venture to a thriving, sustainable business.

Alternative Financing: Beyond Banks & Credit Cards

While traditional bank loans are often the first option that comes to mind, they aren’t always

Taking out a loan is one thing, but making it work without falling into a cycle of debt is another. Many side hustlers get excited about having extra capital, only to realise later that poor planning can turn even a small loan into a financial headache. That’s why careful budgeting is essential when handling small business loans for side hustles. Let’s break it down.

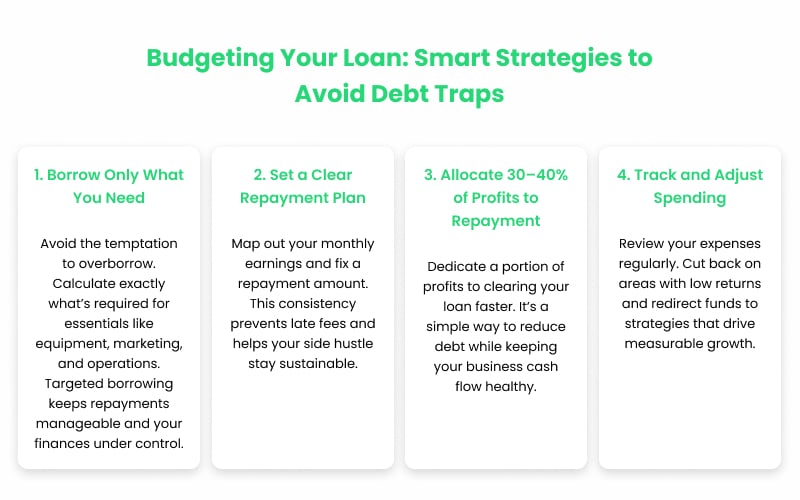

1. Only Borrow What You Need

It’s easy to assume that taking a bigger loan gives you more flexibility. In reality, borrowing more than necessary leads to higher interest payments and added stress. Calculate exactly how much is required for equipment, inventory, marketing, or operational costs. Keeping your borrowing targeted ensures your small business loan for side hustles drives growth without creating unnecessary financial pressure.

2. Create a Loan Repayment Plan

A clear repayment strategy is crucial. Estimate your monthly earnings and set aside a fixed portion to repay your loan. This approach ensures that your side hustle continues to operate smoothly while your small business loan for side hustles is paid off systematically. Knowing exactly how much you need to allocate each month eliminates uncertainty and prevents late fees.

3. Allocate 30–40% of Profits for Repayment

If your side hustle is already generating revenue, earmark a portion of profits specifically for loan repayment. This reduces debt faster while keeping your business financially healthy. Treating your small business loan for side hustles as a strategic investment rather than disposable cash helps you maintain control and ensures the loan contributes meaningfully to growth.

4. Track Expenses and Adjust as Needed

Regularly review how funds are being used. If certain expenses don’t yield expected results, redirect money toward areas that generate better returns. By monitoring your finances, you can make sure your small business loans for side hustles truly support expansion and long-term success.

Focusing on only what you need, planning repayments carefully, and tracking your expenses ensures that every dollar contributes to building a stronger, more sustainable side hustle. Responsible financial management today lays the foundation for long-term success tomorrow.

How to Make Your Loan Work for You

Once you’ve borrowed funds, the real work begins: turning your loan into measurable business growth. The key is to treat every dollar as an investment rather than just extra cash. With small business loans for side hustles, this mindset ensures you’re building value rather than accumulating debt.

1. Track ROI (Return on Investment)

Every expense funded by your loan should contribute to your side hustle’s growth. Whether it’s marketing campaigns, equipment upgrades, or software tools, monitor how these investments impact sales, productivity, and client engagement. If a particular expense isn’t delivering results, adjust your strategy promptly. Using small business loans for side hustles strategically ensures your capital is allocated where it creates the most impact.

2. Reinvest Profits into the Business

Instead of spending all profits on personal expenses, consider reinvesting a portion back into your venture. Upgrading tools, hiring additional help, or expanding production capacity allows your side hustle to scale steadily. By using small business loans for side hustles in combination with reinvested profits, you create a cycle of growth that maximises the value of every borrowed dollar.

Ultimately, your loan should be a stepping stone to sustainable growth. Regularly evaluate results, reinvest wisely, and continue tracking ROI to ensure your small business loans for side hustles truly work for you.

Frequently Asked Questions

1. What’s the difference between a personal loan and a business loan for my side hustle?

A personal loan is easier to obtain and doesn’t require your business to be officially registered, making it ideal for freelancers or small-scale entrepreneurs. Business loans, however, often provide larger funding amounts but require proof of financials and incorporation of the company, making them more suitable for SMEs.

2. How fast can I get a loan from a licensed money lender in Singapore?

Licensed money lenders typically process loans within 30 mins to 1 hour, making them much faster than banks, which may take weeks for approval. If you need quick capital for an urgent business need, this instant loan approval plan is a great option.

3. What happens if I can’t repay my loan on time?

Late repayments result in additional interest charges and penalty fees, which can increase your total debt. To avoid this, always plan your repayment schedule in advance and prioritise timely payments to maintain financial stability. Some moneylenders, such as 118 Credit do have the option for GIRO repayments which ensures that your loan is paid on time.

4. Can I apply for a loan if I’m self-employed or a freelancer?

Yes! Many licensed money lenders accept applications from freelancers and self-employed individuals. You may need to provide proof of income, such as recent invoices or bank statements, but the approval process is often simpler than with traditional banks.

Conclusion

A small loan can be the key to scaling your side hustle into a profitable business, but only if used wisely. Managing side hustle finances effectively means borrowing strategically, investing in growth areas, and planning repayments properly. The key takeaway? Your side hustle should work for you, not the other way around. With smart financial planning, the right loan can help you turn your business dreams into reality faster than saving up for years.

Ready to take your side hustle to the next level? Explore flexible financing options with 118 Credit and start building your future today! Contact us to get started.