Introduction

There are plenty of money-lending myths in Singapore that make people hesitant to seek financial help, even when they truly need it. Tales of excessive interest rates, unethical practices, and unclear legal protection often spark unnecessary fear. Over time, these stories have led many to distrust all lenders, including those who are fully licensed and follow the law.

Being cautious with money matters is wise, but it is equally important to tell apart what’s true from what’s not. Understanding the facts helps you make sound decisions without letting fear or misinformation get in the way.

In this article, we’ll unpack and debunk some of the most common money-lending myths in Singapore. You’ll also learn how licensed moneylenders are regulated and how to borrow responsibly with greater confidence and peace of mind.

Key Takeaways:

- Borrowing from licensed lenders in Singapore is a regulated process that protects borrowers through clear laws and ethical standards.

- Many common misconceptions about lending stem from confusion between legal lenders and illegal operators.

- Transparency, documentation, and government oversight make legitimate lending a safe and practical financial option.

- Verifying a lender’s licence, understanding loan terms, and debunking money-lending myths can help borrowers make clear, confident financial decisions.

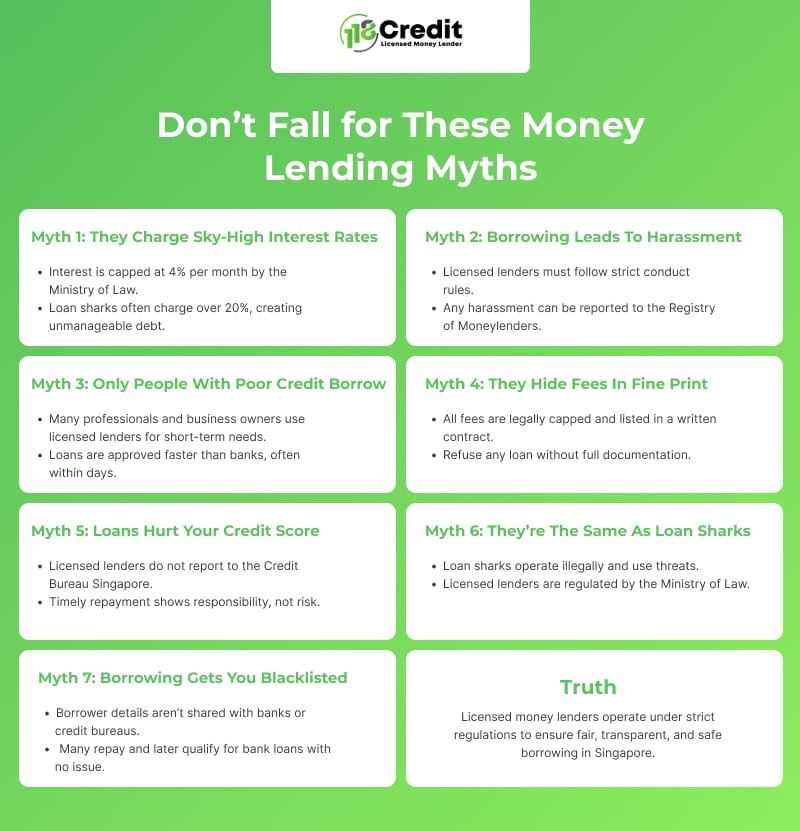

Common Myths About Licensed Moneylenders

Misinformation can spread quickly, especially when it comes to borrowing money. Over time, a number of money-lending myths have made people hesitant to seek help from legitimate lenders, often because of fears about unfair interest rates or bad experiences they’ve heard from others. The truth is, Singapore has clear laws in place to protect borrowers and promote ethical lending.

Let’s take a closer look at some of the most common money-lending myths and uncover the real facts behind them so that you can borrow with confidence and peace of mind.

Myth #1: Licensed Moneylenders Charge Extremely High Interest Rates

One of the most common money-lending myths is that all licensed lenders charge sky-high interest rates. In reality, every licensed moneylender in Singapore is regulated by the Ministry of Law, which sets strict limits on the amount of interest that can be charged. The maximum rate allowed is 4% per month, regardless of your income level or the size of your loan. This rule ensures that borrowing remains fair, transparent, and manageable for everyone.

Illegal lenders, however, operate outside these regulations. Many loan sharks demand shockingly high interest rates that can exceed 20% per month, trapping borrowers in a cycle of debt. These unlicensed operators are not subject to any oversight, making them a risky and unsafe option to deal with. For safe borrowing in Singapore, always check that your lender appears on the official list of licensed moneylenders published by the Ministry of Law.

Myth #2: Borrowing from a Moneylender Will Lead to Harassment

A common worry among borrowers is that taking a loan could lead to threats or harassment. This is one of the most harmful money-lending myths because it unfairly links licensed moneylenders with illegal ones. In reality, licensed lenders in Singapore are required to follow strict rules under the country’s personal loan regulations, which clearly prohibit any form of intimidation or aggressive debt collection.

If you ever feel uncomfortable or experience harassment from a lender, you have complete legal protection. The Registry of Moneylenders allows borrowers to file formal complaints and will investigate any reports of misconduct. Those found guilty face penalties, suspension, or even a loss of their licence. These safeguards are in place to ensure borrowers are treated fairly and that the industry remains professional and trustworthy.

Myth #3: Only People with Poor Credit Take Loans from Moneylenders

Another widespread myth about money lending is the belief that only people facing financial trouble turn to licensed lenders. In reality, that’s far from true. Many professionals, business owners, and even homeowners approach licensed moneylenders when they need short-term financial support or quick access to cash.

Banks often require extensive documentation and may take weeks to process a loan application. Licensed lenders, on the other hand, can approve and disburse loans within a day or two, making them a convenient choice during time-sensitive situations. Borrowing from a reputable moneylender should not be seen as a last resort; it’s simply a flexible and efficient way to manage temporary financial needs.

Myth #4: Licensed Moneylenders Have Hidden Fees That Trap Borrowers

Another common money-lending myth is that licensed lenders sneak hidden charges into the fine print to trap borrowers into paying more than they expect. In truth, this misconception couldn’t be further from reality. In Singapore, all fees charged by licensed moneylenders are legally capped and must be clearly stated in the loan contract. Charges, such as late fees or processing fees, cannot exceed the limits set by the Ministry of Law.

Before releasing any funds, a licensed lender is required to issue a written contract that details the total cost of the loan, including the interest rate and any applicable administrative fees. Borrowers should never proceed with any lender who refuses to provide this documentation. This transparency is part of Singapore’s strong framework for safe borrowing, ensuring that both lenders and borrowers operate with clarity and fairness.

Myth #5: Taking a Loan from a Moneylender Will Harm My Credit Score

Many people worry that borrowing from a licensed moneylender might hurt their credit score, but this belief is another money-lending myth. In reality, your credit rating stays unaffected as long as repayments are made on time. What damages your financial reputation is failing to repay or repeatedly missing instalments, not the act of borrowing itself.

It’s also worth noting that licensed moneylenders in Singapore do not report to the Credit Bureau Singapore (CBS). This means your borrowing activity with them will not impact your eligibility for future bank loans or credit cards. By repaying on schedule, you demonstrate financial responsibility and build a positive reputation for managing commitments well.

Myth #6: Moneylenders Are the Same as Loan Sharks

Perhaps one of the most misleading money-lending myths is the notion that licensed moneylenders operate in the same manner as loan sharks. In truth, the two couldn’t be more different. Loan sharks, or “Ah Longs” as they’re known locally, operate illegally and often use threats or intimidation to recover debts. Licensed moneylenders, however, are regulated by Singapore’s Ministry of Law and must follow strict professional and ethical standards.

All licensed lenders must clearly identify themselves and operate under registered business names. They are also prohibited from contacting clients through personal messaging apps or unverified numbers. To stay protected and ensure safe borrowing in Singapore, always check the Ministry of Law’s official list to confirm that a lender is properly licensed before proceeding with any application.

Myth #7: Borrowing From a Licensed Moneylender Means Getting Blacklisted

Some borrowers worry that taking a loan from a licensed lender will automatically get them blacklisted, but this is another of those money-lending myths that simply isn’t true. Licensed moneylenders do not share borrower details with banks or financial institutions, and they do not report to the Credit Bureau Singapore (CBS).

In fact, many borrowers who have fully repaid their loans go on to secure bank financing or credit cards without any trouble. This shows that borrowing from a legal moneylender has no negative impact on your long-term financial standing. What truly matters is responsible repayment and keeping clear communication with your lender throughout the process.

Together, these facts help dispel the money-lending myths that have stopped many people from exploring legitimate financial solutions. By understanding your rights, familiarising yourself with the regulations, and selecting a properly licensed lender, you can approach borrowing in Singapore with greater confidence, security, and peace of mind.

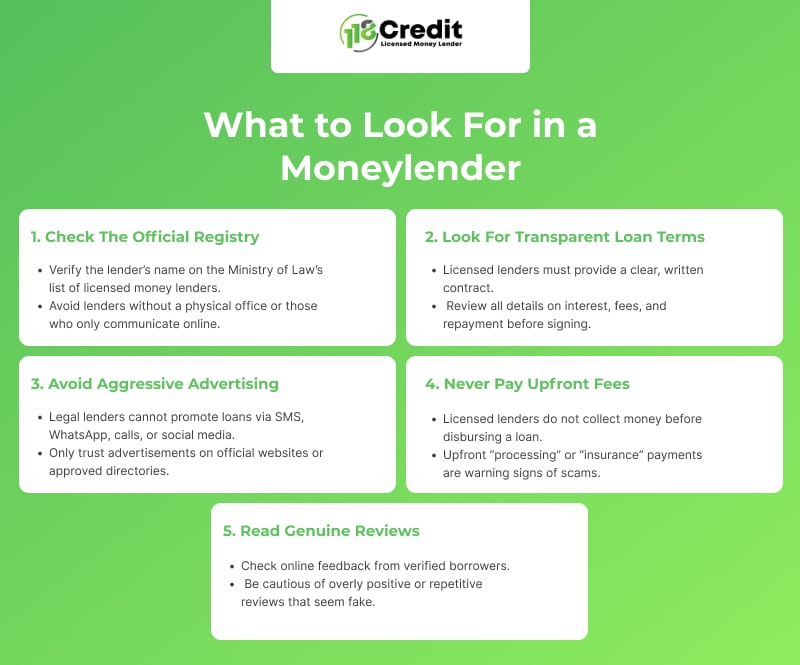

How to Identify a Trustworthy Moneylender

Even with greater awareness about money-lending myths, choosing the right lender can still feel overwhelming. Singapore’s lending scene encompasses both licensed and unlicensed operators, so distinguishing between them is crucial before taking any financial step. A trustworthy lender will always prioritise transparency, adhere to the law, and treat borrowers with professionalism. Here’s how you can recognise one before committing to a loan.

Verify the Lender on the Official Registry

Before signing any loan agreement, always check the Ministry of Law’s official list of licensed moneylenders. This registry confirms that the business is legally recognised and authorised to operate in Singapore. If a company’s name isn’t listed, it’s best not to proceed; doing so could expose you to unlicensed operators.

Licensed moneylenders are also required to maintain a physical office in Singapore, where they conduct face-to-face verification and documentation. Be cautious of lenders who operate only online, communicate solely through messaging apps, or refuse to meet in person. These are strong signs of illegitimate activity and often the root of many money-lending myths that discourage safe borrowing.

Ensure Transparency in Loan Terms

A trustworthy lender will always be upfront about every detail of your loan. Under the Moneylenders Act of Singapore, all licensed moneylenders are required to explain all the terms of the loan and provide a written, legally binding contract. This document should clearly state the interest rate, repayment schedule, late payment fees, and any other terms in language that’s easy to understand.

Be wary of lenders who pressure you to sign quickly or discourage you from reading the contract carefully. That kind of urgency is often a red flag for unethical behaviour. A legitimate moneylender will always give you time to review the agreement and answer your questions before you decide to proceed.

Avoid Moneylenders That Advertise Aggressively

Aggressive or unsolicited advertising is one of the clearest signs of an unlicensed lender. Under Singapore law, licensed moneylenders are prohibited from promoting their services through SMS, WhatsApp, cold calls, email, or social media advertisements. Any lender operating in this manner is likely to be doing so illegally and should be avoided.

Legitimate lenders are only permitted to advertise through their official website, approved business directories, or physical signage displayed at their registered office. Knowing this helps you identify the difference between genuine lenders and scams that target unsuspecting borrowers seeking fast cash. Misunderstanding these practices has led to many money-lending myths, but being aware of the rules keeps you safe from deception.

Be Wary of Loans That Require Upfront Payments

No licensed moneylender in Singapore will ever ask for money before releasing your loan. Some unlicensed operators may claim that advance payments are needed for “processing” or “insurance”, but these are fraudulent tactics meant to deceive borrowers.

A legitimate lender will only deduct a small, approved processing fee directly from the loan amount after the loan is approved. If you are asked to transfer money or make any payment before receiving your funds, it’s a major red flag. Walk away immediately and report the incident to the authorities to avoid becoming a victim of a scam.

Read Reviews and Customer Feedback

In today’s digital world, one of the easiest ways to gauge a lender’s reliability is by checking online reviews and testimonials. Honest feedback from past borrowers can reveal how a lender operates, their transparency, and the quality of their customer service.

At the same time, be cautious of reviews that sound overly polished or use identical wording across different platforms, as these may not be genuine. A reputable money loaner often has balanced feedback that includes both praise and constructive comments. Look for consistent mentions of fairness, clarity, and professionalism when assessing a lender’s reputation.

Frequently Asked Questions

How can I confirm if a moneylender is licensed?

You can verify a lender’s legitimacy by visiting the Ministry of Law’s official list of licensed moneylenders on their website. The list is regularly updated and includes each lender’s business address and contact details. If the lender you are dealing with is not on the list, it is safest to avoid them entirely.

What happens if I miss a loan repayment?

If you miss a repayment, the lender may charge a late interest of up to 4% per month on the overdue amount, along with a one-time late fee of up to S$60. However, harassment and intimidation are strictly prohibited under Singapore law. If you are facing financial difficulties, speak to your lender about adjusting your repayment schedule instead of ignoring the issue.

Are licensed moneylenders a better alternative to banks?

Licensed lenders and banks serve different purposes. Banks usually offer lower interest rates but require more paperwork and longer approval times. Licensed lenders, on the other hand, provide faster access to funds, making them helpful for short-term financial needs. For borrowers who do not meet bank requirements, licensed lenders offer a secure and regulated option that supports safe borrowing in Singapore. This helps debunk many money-lending myths that wrongly portray all non-bank loans as risky or predatory.

Can I get a loan if I am a foreigner living in Singapore?

Yes. Foreigners with a valid work pass and proof of employment are eligible to apply for loans from licensed lenders. The amount approved will depend on your monthly income and job stability. Licensed lenders are transparent about eligibility, ensuring the process remains fair for both locals and foreigners.

What should I do if I suspect a moneylender is operating illegally?

If you suspect a lender is operating without a license, stop all contact immediately. You can report them to the Registry of Moneylenders under the Ministry of Law. If they use threats, harassment, or illegal collection methods, contact the police right away. Understanding how to identify licensed lenders and being aware of money-lending myths helps you stay protected and borrow with confidence.

Conclusion

Many money-lending myths still cause confusion and hesitation among people who genuinely need financial support. These misconceptions often blur the difference between licensed and illegal lenders, discouraging some from seeking legitimate options that can provide timely and responsible help.

In truth, licensed moneylenders in Singapore operate under strict regulations set by the Ministry of Law. These rules ensure that all lending practices remain transparent, ethical, and fair. From capped interest rates to clear documentation, every safeguard is in place to protect borrowers and promote safe borrowing in Singapore.

By understanding and debunking money-lending myths, individuals can make informed decisions and approach financial matters with greater confidence. Borrowers can also take comfort in knowing that licensed lenders follow established loan regulations designed to protect their interests.

If you are considering a legal and transparent borrowing option, 118 Credit offers professional guidance, flexible plans, and clear terms that make the process simple and secure. Visit us today to explore loan options that fit your financial needs and experience the assurance of working with a licensed, trustworthy moneylender in Singapore.