Introduction

Singapore is a true cultural mosaic, where Chinese, Malay, Indian, and Eurasian traditions coexist and influence almost every aspect of daily life, including financial habits. From saving patterns to how people perceive debt, cultural values play a big role in shaping how individuals approach money lending traditions.

For many, borrowing money is not merely a financial transaction but a reflection of personal responsibility, social reputation, and community trust. While some view loans as practical tools for achieving financial goals, others see borrowing as something to be avoided unless absolutely necessary.

These perspectives stem from deeply rooted money lending traditions that have evolved over generations. In some communities, collective saving schemes foster mutual support, while in others, borrowing carries emotional weight tied to pride and self-sufficiency.

In this guide, we’ll explore how these cultural dynamics influence borrowing behaviour in Singapore, how religious and community practices shape financial decisions, and how modern licensed moneylenders are adapting their services to align with evolving social norms. By understanding these influences, both borrowers and lenders can engage in more culturally respectful, transparent, and meaningful financial interactions.

Key Takeaways

- Cultural values deeply influence borrowing behaviour: Concepts like “saving face,” community-based savings schemes, and religious principles continue to shape how Singaporeans approach borrowing, reflecting longstanding lending traditions.

- Modern adaptations make borrowing more accessible: Licensed moneylenders are offering culturally sensitive products, flexible repayment options, and Shariah-compliant loans to meet diverse needs while respecting heritage and personal values.

- Attitudes toward borrowing are evolving: Younger generations are increasingly viewing loans as strategic financial tools rather than a sign of financial struggle, signalling a shift in money lending traditions toward transparency, responsible lending, and financial empowerment.

The Concept of “Saving Face” and Borrowing Reluctance

Before we dive in deeper, let’s first understand one of the most defining cultural values influencing money lending traditions in Singapore, the concept of “saving face.”

In many Asian societies, including Singapore’s Chinese, Malay, and Indian communities, maintaining one’s reputation and dignity in the eyes of others is a deeply ingrained social principle. “Saving face” refers to protecting one’s honour and avoiding situations that may lead to embarrassment or social shame.

When it comes to borrowing money, this value takes on significant meaning. For some, seeking financial assistance, especially from a moneylender, may be perceived as an admission of financial mismanagement or failure. This perception can make individuals hesitant to approach lenders, even when facing genuine financial difficulties.

This reluctance often pushes people to explore informal options, such as borrowing quietly from family members or relying on traditional community lending circles. While these approaches may preserve personal pride, they can also delay timely financial relief or expose borrowers to unreliable lending sources.

Understanding how “saving face” shapes attitudes toward borrowing is key to recognising why some individuals avoid formal financial assistance. Licensed moneylenders who are aware of these money lending traditions can create an environment of privacy, empathy, and respect, helping clients feel supported rather than judged.

By reframing borrowing as a responsible and strategic choice rather than a sign of weakness, lenders can honour traditional money lending traditions while promoting healthier financial behaviours within the community.

Community-Based Lending and Rotating Savings Schemes

While the idea of “saving face” often shapes how individuals approach borrowing, it has also led to the development of alternative financial systems rooted in trust and community support. One of the most enduring examples of this is the tradition of community-based lending, a key part of Singapore’s money lending traditions that continues to thrive even in today’s modern economy.

1. Distinct Forms Across Cultural Groups

Across different communities, these informal money lending traditions have taken unique forms:

- Malay ‘Kutu’: Members contribute a fixed amount regularly into a collective pool, taking turns to receive the total sum.

- Indian ‘Chit Funds’: Operates on a shared contribution and rotation principle, similar to the ‘kutu’.

- Chinese ‘Hui’: Participants withdraw from a common fund in turns, fostering mutual support within the group.

2. The Role of Trust and Social Accountability

What makes these systems enduring is the element of trust and social accountability. Members are often part of the same social circle, friends, family, or co-workers, which reduces the risk of default and reinforces collective responsibility. For many, these rotating savings schemes are more than financial tools; they strengthen social bonds and mutual reliance.

3. Limitations and Modern Adaptations

Despite their cultural richness and reliability within close groups, these systems have practical limitations. The total pool is often small, contributions are fixed, and disputes can arise if a member fails to meet obligations. As financial needs grow, from funding business ventures to covering medical or education expenses, individuals increasingly turn to licensed moneylenders for structured, legal, and transparent options.

Modern moneylending, in this sense, acts as an extension of traditional money lending traditions, preserving the communal spirit of trust while offering greater financial flexibility and security. By bridging heritage and modernity, Singapore’s financial ecosystem continues to honour its cultural roots while meeting today’s diverse financial needs.

Religious Perspectives on Borrowing and Interest Rates

Beyond community-driven systems, another powerful influence on how Singaporeans view borrowing comes from religion. Spiritual beliefs often shape one’s sense of financial ethics and responsibility, making them a significant part of Singapore’s broader money lending traditions.

For example, in the Muslim community, Islamic finance principles strictly prohibit ‘riba’, or interest-based lending. This makes conventional borrowing less appealing to devout Muslims, who may instead seek financial arrangements that align with Shariah law. In response, some licensed moneylenders have begun offering Shariah-compliant loan structures or profit-sharing models to cater to these preferences, a thoughtful adaptation that respects faith while providing access to legitimate financial solutions.

Similarly, Hindu and Buddhist teachings emphasise the moral weight of debt and the concept of karma. Borrowing irresponsibly or failing to repay a loan can be seen as creating negative consequences, both materially and spiritually. This encourages a disciplined and ethical approach to financial commitments.

By understanding these faith-based perspectives, licensed moneylenders can engage borrowers with greater empathy and awareness. Incorporating religious sensitivity into modern lending practices ensures that Singapore’s money lending traditions continue to evolve in a way that honours both cultural identity and spiritual integrity.

Culturally Sensitive Loan Offerings and Marketing

As we’ve seen, culture and religion play an undeniable role in shaping how Singaporeans view borrowing. Recognising this, modern licensed moneylenders are taking active steps to adapt, blending traditional money lending traditions with contemporary financial practices to create offerings that feel both familiar and respectful.

1. Tailored Loan Offerings

To accommodate Singapore’s multicultural society, some moneylenders have introduced products that align with different cultural and religious values. Interest-free instalment plans or flexible repayment structures during festive periods, such as Chinese New Year, Hari Raya, or Deepavali, help borrowers manage temporary spikes in expenses without added stress.

For Muslim clients, Shariah-compliant loans that avoid interest (riba) provide an ethical and practical alternative, showing respect for faith-based financial principles. These culturally attuned offerings demonstrate that borrowing can be responsible, practical, and aligned with personal values, a natural evolution of traditional money lending traditions.

2. Culturally Relevant Marketing Strategies

Marketing also plays a major role in reshaping perceptions around borrowing. Trusted urgent moneylenders now focus on positive, culturally aware messaging that emphasises empowerment, responsibility, and community support. Campaigns often highlight family care, stability, and integrity, values central to Singapore’s money lending traditions. By framing loans as tools for achieving goals rather than a sign of financial struggle, lenders help dismantle old stigmas and build trust with borrowers from all backgrounds.

Through these dual approaches, product innovation and thoughtful communication, licensed moneylenders are creating a culturally inclusive financial environment where borrowing is respected, responsible, and accessible to everyone.

Changing Attitudes Towards Borrowing in Younger Generations

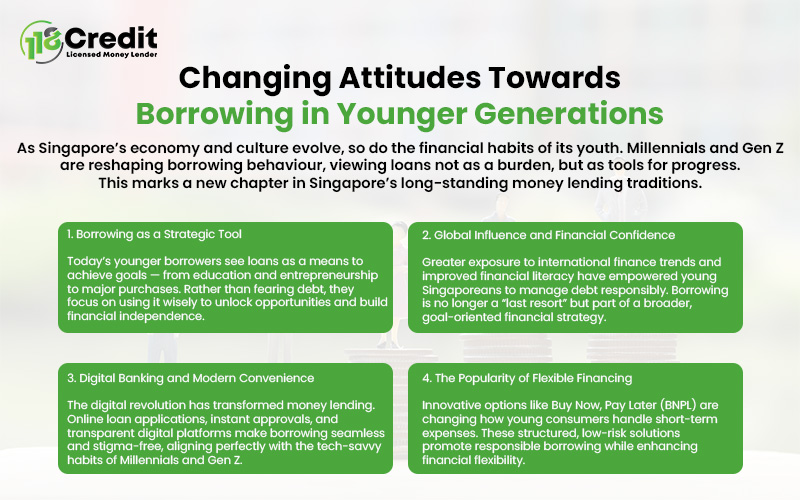

As Singapore evolves, so too does the mindset of its younger population. Millennials and Gen Z are increasingly redefining borrowing, moving away from the cautious approach of previous generations and embracing loans as practical financial tools. This shift reflects a broader transformation in Singapore’s money lending traditions.

1. Influence of Global Trends and Financial Literacy

Exposure to international financial practices and financial education has made younger Singaporeans more confident in managing debt responsibly. Unlike older generations, who often viewed borrowing as a last resort, young adults see loans as a means to achieve specific goals, from funding education to investing in business opportunities or making significant purchases. This perspective reframes borrowing as a strategic decision rather than a sign of financial struggle.

2. Digital Banking and Convenient Loan Processes

The rise of digital banking has further accelerated this shift. Licensed moneylenders now offer online applications, instant approvals, and user-friendly interfaces designed for tech-savvy borrowers. These innovations make the borrowing process more transparent and accessible, reducing the stigma often associated with loans and modernising traditional money lending traditions.

3. The Rise of Flexible Financing Options

Short-term, interest-free options like Buy Now, Pay Later have also contributed to changing attitudes. Structured repayment plans allow borrowers to manage expenses responsibly while avoiding financial stress, reinforcing the idea that borrowing can be both safe and strategic. This approach aligns with evolving money lending traditions that balance trust, transparency, and convenience.

Even as younger generations embrace these modern approaches, the core values of trust and ethical lending remain central. Licensed moneylenders who respect cultural norms while offering innovative solutions help ensure that Singapore’s money lending traditions continue to evolve, supporting a financially empowered new generation.

Frequently Asked Questions

1. Are traditional community lending practices still relevant today?

Yes, traditional community-based lending methods like ‘kutu’ (Malay), ‘chit funds’ (Indian), and ‘hui’ (Chinese) are still practised within close-knit groups. These informal lending circles foster trust and mutual financial support and are a reflection of longstanding money lending traditions.

However, their limitations, such as the lack of legal protections, fixed contributions, and potential default risks, mean that many people also turn to licensed moneylenders for more structured and reliable financial solutions, especially for urgent or larger expenses.

2. How can licensed moneylenders respect cultural sensitivities?

Legal moneylenders can adopt several strategies to align their services with cultural preferences. These include offering Shariah-compliant loans that do not involve interest (riba), providing flexible repayment terms to cater to different financial backgrounds, and using culturally respectful language in marketing and communication. Such approaches demonstrate cultural awareness and build trust with borrowers from diverse communities.

3. Does borrowing always have a negative stigma in Singapore?

Traditionally, borrowing money, especially from a moneylender, was associated with financial distress or mismanagement. However, attitudes are shifting, particularly among younger generations who view loans as practical tools for investment, education, or business growth.

With improved financial literacy, responsible borrowing is increasingly seen as a strategic way to manage expenses rather than a sign of financial struggle. Licensed moneylenders that promote responsible lending and financial education are helping normalise borrowing as a safe and informed financial decision.

4. Can borrowing practices evolve while respecting cultural values?

Absolutely. While traditional methods like ‘kutu’, ‘chit funds’, and ‘hui’ remain part of Singapore’s financial landscape, modern borrowing practices can coexist with these long-standing traditions. Licensed moneylenders are increasingly offering flexible, culturally sensitive solutions that honour communal and religious values while providing legal protection and convenience. This allows borrowers to benefit from modern financial tools without feeling disconnected from their cultural roots, bridging heritage with contemporary financial needs.

Conclusion

Cultural traditions continue to play a vital role in shaping borrowing behaviour in Singapore. From the importance of “saving face” to community-based lending practices and religious influences on interest and debt, Singapore’s diverse population has long followed distinctive money lending traditions. These practices reflect a deep respect for trust, accountability, and social harmony, guiding how individuals approach financial decisions.

At the same time, the financial landscape is rapidly evolving. Younger generations are adopting more open attitudes toward borrowing, influenced by digital banking, fintech solutions, and greater financial literacy. Good moneylenders in Singapore are responding by offering culturally sensitive products, flexible repayment options, and transparent, responsible services. This approach preserves the essence of traditions while meeting the needs of a modern, tech-savvy population.

So, if you’re looking for a loan that respects your financial needs and cultural preferences, explore the services available at 118 Credit. Our licensed moneylenders provide transparent, flexible, and culturally considerate loan solutions, helping you access the funds you need with confidence and peace of mind. Embrace responsible borrowing today while honouring Singapore’s rich traditions.